Experience business growth with an Elgin location, strategically positioned near Chicago's global markets and innovation hubs. Benefit from lower operating costs and a high quality of life while tapping into a skilled workforce. From startups to established corporations, Elgin fosters a supportive environment for your enterprise to thrive. Join the Chicago Metropolitan area's competitive edge while enjoying Elgin's unique advantages. Seize the opportunity for innovation and success in Elgin today.

What makes Elgin a Prime Business Location?

Center of Economic Hub

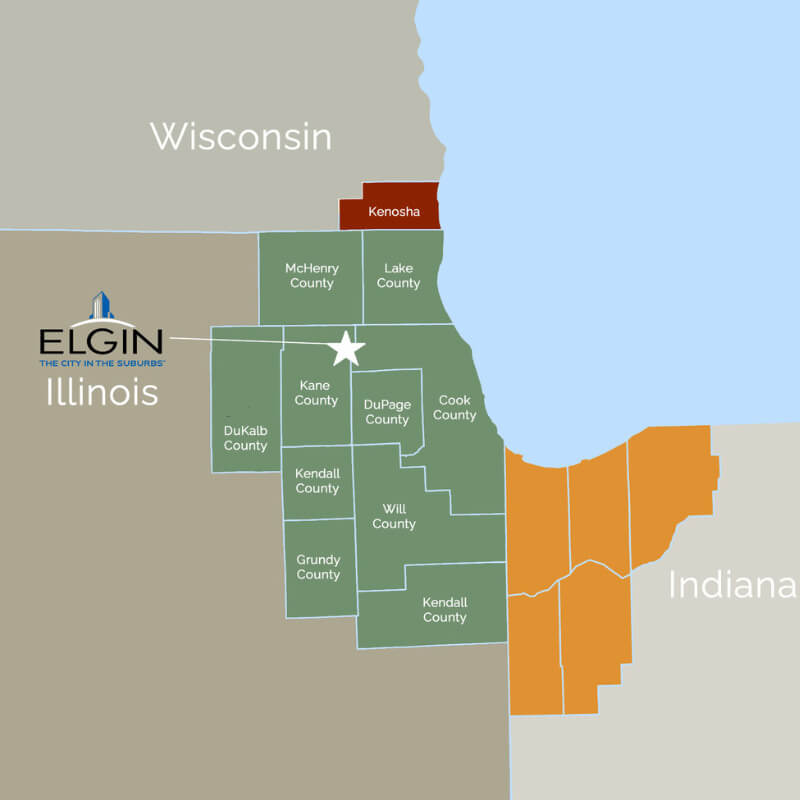

Elgin's strategic location within the Chicago Metropolitan area provides businesses with proximity to a major urban center. We are situated 35 miles from downtown Chicago, providing access to a major economic hub and a vast consumer market.

Skilled Workforce

The region boasts a skilled and diverse workforce, with access to graduates from nearby universities and technical schools. Elgin Community College, for instance, offers educational opportunities that align with local business needs.

Transportation Infrastructure

Elgin is well-connected with major transportation arteries, including highways I-90, I-88, and Route 20, making it convenient for businesses to transport goods and connect with regional and national markets.

- 2nd largest public transportation system

- 2nd largest rail system

- 3rd largest interstate system

- 4th largest highway system

- one of the biggest international airport systems - O'Hare International Airport.

- 6th largest city in Illinois and growing!

Business-Friendly Environment

Elgin is known for its business-friendly environment, with resources and programs provided by organizations like the Elgin Development Group, aimed at assisting businesses with growth, development, and navigating local regulations.

Our services are free and confidential

Low Cost of Business

Elgin has a relatively low cost of doing business compared to neighboring cities. Several factors contribute to this:

- Affordable Real Estate: Elgin offers a range of affordable commercial real estate options.

- Lower Taxes: The tax structure in Elgin is often more favorable. This includes property taxes, sales taxes, and corporate taxes.

- Lower-Cost Utilities Elgin benefits from competitive electric, natural gas, and water rates.

Unlock the Secrets of Successful Elgin Business

Check out the video featuring Mike Higgins, former CEO of Elgin Sweeper, uncovering how this lively city nurtures business growth and teamwork, directly from one of its most knowledgeable advocates!

EDG Simplifies the Location Process

Here's how we help make the process hassle-free:

1. Site Selection Assistance:

- Our Economic Development team can provide a curated list of potential Elgin locations that align with your business needs and requirements.

- We'll offer insights into the local real estate market, zoning regulations, and available incentives or tax benefits for your industry.

2. Networking and Partnerships:

- We can connect you with key stakeholders, including local businesses, suppliers, and industry associations, fostering valuable partnerships. We can facilitate introductions to potential customers or clients, helping you establish a network in the new location.

3. Regulatory Guidance and Incentives:

- We will guide you through the necessary permits, licenses, and regulatory requirements for your specific industry in Elgin, IL.

- We may also inform you about any economic incentives, grants, or financial assistance programs offered by the state to support your relocation.

Elgin, Illinois boasts a top 10% ranking for quality of life in the United States, according to Niche.com.

Unlock Your Business Potential in Elgin, Illinois

Connect with us today! Our team of experts will be happy to discuss your business needs, showcase Elgin's advantages, and help you explore the potential for your company to thrive in our vibrant community.